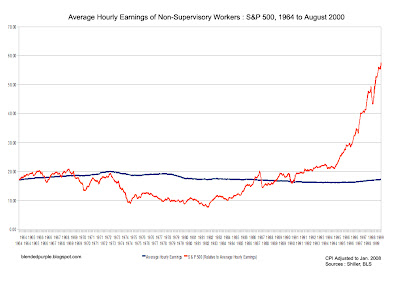

While Wall Street partied for a generation, the average hourly wage stagnated or declined. The younger generation did no better, or even a little worse than their parents, on average. Families worked more hours, not less.

For the bottom 90 % of the income bracket, the economy has been slow for a long time; the average hourly wage peaked in January of 1973, and it now stands 10 % less than that peak. The S&P 500 peaked in August of 2000 with gains of 210%, relative to January of 1973. After a new top, it crashed with avengeance in 2008.

There is an economic crisis, but it's in the news because the elite have seen their wealth evaporate. Relative to the American public, the top 1 %, hold 50 % of total investment assets, and the top 10 % hold 85 %. So now, in this real crisis, Wall Street has to be bailed out - after acting like a drunk driver crossing lanes on the highway, endangering everyone else.

Their greed and hubris at the top of the bubble should not be forgotten. They celebrated a mirage, and now it's gone.

----

stats

source on wealth distribution

No comments:

Post a Comment